wyoming tax rate for corporations

There is a huge amount of revenue generated from corporate income tax. 52 rows Most states set a corporate tax rate in addition to the federal rate.

Corporate Income Tax Definition Taxedu Tax Foundation

See the publications section for more information.

. State wide sales tax is 4. The sales tax is about 542 which is fairly low. Personal rates which generally vary depending on the amount of income can range from 0 for small amounts of taxable income to around 9 or more in some states.

An LLC may accumulate earnings of up to 250000 without incurring this tax. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. What is the Wyoming corporate net income tax rate.

Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2. Sales Use Tax Rate Charts Please note. Explore data on Wyomings income tax sales tax gas tax property tax and business taxes.

Dont gamble on Nevada. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. Corporations pay a 21 percent income tax rate to the federal government the tax foundation reported but they also pay additional corporate taxes in 44 states and washington dc.

In 2017 this rate was pushed up to 35 but was reduced by the Tax Cuts and Jobs Act. Wyoming is one of seven states that do not collect a personal income tax. Nonprofit Corporations and Cooperative Marketing Associations.

This is typically at a rate of 153 percent. Corporations can earn a profit be taxed as well as can be held legally accountable. However revenue lost to Wyoming by not having a personal income tax may be made up through other state-level taxes such as the Wyoming sales tax and the.

Easy to move your company to Wyoming. Wyoming has no state income tax. Tax rate charts are only updated as changes in rates occur.

Wyoming C Corp Tax Rate. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external collection agency. There are a total of 82 local tax jurisdictions across the state collecting an average local tax of 1354.

Wyoming has been consistently ranked as the most tax friendly state in the union. In the United States as of 2020 corporations must pay a federal tax rate of 21 percent. Though often thought of as a major tax type corporate income taxes accounted for an average of just 466 percent of state tax collections and 227 percent of state general revenue in fiscal year 2018.

4 percent state sales tax one of the lowest in the United States. One tax rate of 21 applies to taxable income. Property tax is assessed at 115 for industrial property and assessed at 95 for commercial residential and all other property.

Articles of IncorporationContinuanceDomestication 5000. A corporation sometimes called a C corporation is a legal entity thats different from its proprietors. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

There is no tax except in two limited circumstances. In Wyoming you will pay no. 1 Recognized built-in gains and 2.

Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your earnings. No personal income taxes. You read that correctly.

But not all states levy a corporation tax rate. Wyoming tax rate for corporations. There is no tax to the LLC on LLC income.

A 7 percent corporate income tax on these operations still means that the state has a very low tax burden but if it makes some of these chains locations outside of Cheyenne Casper and Laramie less viable that could have a profound impact on peoples daily lives. This will cost you 325 for a corporation or an LLC. No entity tax for corporations.

Corporations are not charged an entity tax in Wyoming. Low property tax percentages. No Personal Income Taxes.

Theres good reason for that. We include everything you need for the LLC. Should You Beginning A C Corp Wyoming C Corp Tax Rate.

The Excise Division is comprised of two functional sections. Which means that in Wyoming you avoid the burden of double taxation. We recommend you form a Wyoming LLC or incorporate in Wyoming.

Wyoming has no corporate income tax at the state level making it an attractive tax. All profits or losses pass through and are taxed to the members. According to the new 2022 edition of the Tax Foundations State Business Tax Climate Index Wyoming has the most business-friendly tax system of any state for the tenth year in a row.

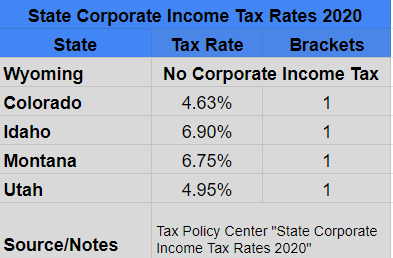

LLCs under a C-Corporation election that accumulate and do not distribute after tax profits are subject to an accumulated earnings tax. Wyoming does have relatively high property tax but if you dont own a home in Wyoming youll never know the difference. State corporate income tax rates range from 0 999.

Average Sales Tax With Local. Some of the advantages to Wyomings tax laws include. Nevada has raised rates on corporations by about 400 in the last 9 years.

Even with added taxes within different counties or municipalities the tax rate is normally no higher than 6 percent. Currently six states Nevada Ohio South Dakota Texas Washington and Wyoming. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

Wyoming Use Tax and You. The following states do not have a state corporate tax rate. Only the Federal Income Tax applies.

Each year youll owe 50 to the State of Wyoming to keep your Wyoming company in good standing and 125 a year to us as your Wyoming Registered Agent. Click Here To Start Your C Corp Today. Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax.

Personal Service Corporations may be taxed at a different rate. Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10. Learn about Wyoming tax rates rankings and more.

Why Businesses Incorporate In Delaware Infographic Delaware Business

Business State Tax Obligations 6 Types Of State Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Map Of The United States Of America With Famous Attractions In 2022 Travel Posters America Map United States Of America

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Is It Advisable To Incorporate A Startup In Wyoming What Are The Pros And Cons And How Does It Compare With Nevada Delaware Quora

State Corporate Income Tax Rates And Brackets Tax Foundation

Corporate Tax Rates By State Where To Start A Business

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Corporate Income Tax Definition Taxedu Tax Foundation

Register Company In Wyoming Within 2 Weeks Tetra Consultants

Under Biden S Proposal Mn Will Have Highest Combined Corporate Income Tax Rate In Oecd American Experiment

Incorporate In Wyoming Wyoming Incorporation Services

Incorporate In Wyoming Do Business The Right Way

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Income Tax Definition Taxedu Tax Foundation

How To Start A Business In Wyoming A How To Start An Llc Small Business Guide

Top 5 Benefits Of Running A Business In Wyoming City Shelf Corp Giant Benefits Of Running Wyoming Cities Wyoming