fidelity maryland tax-free bond fund

Muni Single State Short-294. Assets are concentrated in investment.

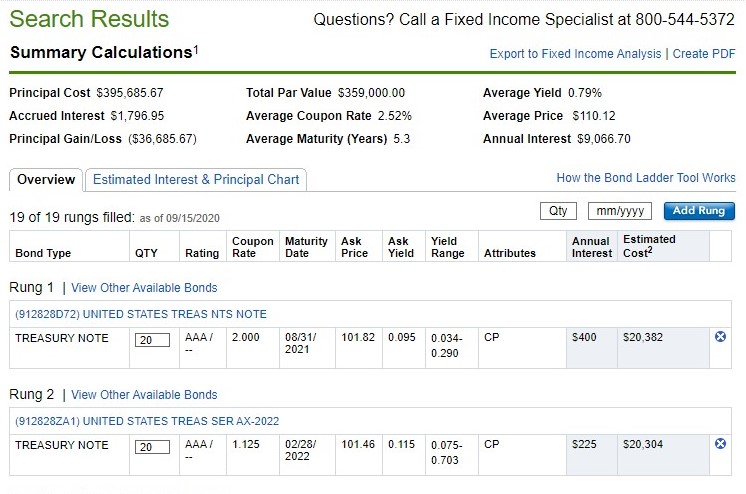

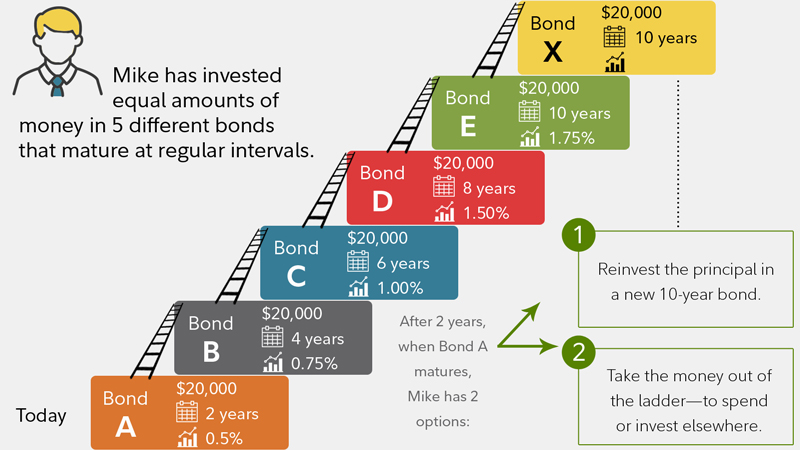

How To Build A Bond Ladder Fidelity

Focuses on long-term securities to provide high yields.

. These are some of the best bond funds that Fidelity has. The fund will invest so that under normal market conditions at least 80 of its net assets including any borrowings for investment purposes are invested in bonds that pay interest. The investment seeks a high level of current income exempt from federal income tax and Maryland personal income taxes.

Ad Learn About The Tax-Exempt Bond Fund of America. 115--After Taxes on Distributions. Normally not investing in municipal.

Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve. Rowe Price Maryland Tax-Free Bond MDXBX. See Franklin Maryland Tax Free Income Fund performance holdings fees risk and other data from Morningstar SP and others.

To get the state-tax benefit these portfolios buy bonds from only. Rowe Price Maryland Tax-Free Bond Fund having Symbol MDXBX for type mutual-funds and perform research on other mutual funds. XNAS quote with Morningstars data and independent analysis.

All Classes Fidelity Flex. Rowe Price Maryland Tax-Free Bond Fund having Symbol MDXBX for type mutual-funds and perform research on other mutual funds. Stay up to date with the current NAV star rating asset.

Your Guide to Munis Is Here. Low-fee Fidelity mutual funds are easy choices for long. The fund normally invests at least 80 of assets in.

State Fidelity Conservative Income Municipal IBond Fund. Utah residents should refer to the letter also available on the fidelity mutual fund tax information page that provides information on the treatment of distributions from fidelity municipal funds. The income from such bonds is generally free from federal taxes and from state taxes in the issuing state.

Fidelity California Limited Term Tax-Free Bond Fund-408 -362 049 106 130 239 BBg Muni -623 -447 153 252 288 381 BBg MunCA En7YNonAMT -394 -364. Your Guide to Munis Is Here. Municipal National Alabama Alaska Arizona Arkansas California Colorado.

Fidelity Tax-Free Bond Fund 0634. Tax-exempt interest dividend income earned by your fund during 2021. Rowe Price Maryland Tax-Free Bond Fd performance holdings fees risk and other data from Morningstar SP and others.

Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax. Analyze the Fund T. Rowe Price Maryland Tax-Free Bond Fd performance holdings fees risk and other data from Morningstar SP and others.

As of April 22 2022 the fund has assets totaling almost 383 billion invested in 1305 different holdings. Fidelity Tax-Free Bond has found its stride. Analyze the Fund Franklin Maryland Tax Free Income Fund Class C having Symbol FMDIX for type mutual-funds and perform research on other mutual funds.

Low-fee Fidelity mutual funds are easy choices for long. Fidelity Maryland Municipal Income SMDMX. Offers Maryland investors triple-tax-free income.

Ad Learn About The Tax-Exempt Bond Fund of America. Fidelity provides tax information about our mutual funds for your reference including state tax-exempt income data as well as information on international funds and corporate actions. Find the latest T.

Rowe Price Maryland Short-Term Tax-Free Bond Fund-193.

Fidelity Mutual Fund Tax Information Fidelity

How To Invest In Bonds White Coat Investor

How To Build A Bond Ladder Fidelity

F G Annuity Power Accumulator 7 Annuity

3 U S Bond Funds To Buy For Yield And Stability In 2022 Investorplace

How To Invest In Bonds White Coat Investor

How Much Fidelity Bond Coverage Are We Required To Have

Does Expense Ratio Really Matter White Coat Investor

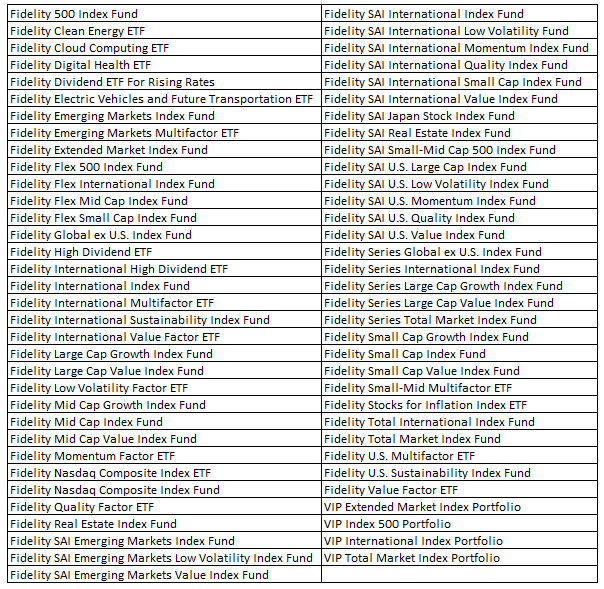

Which Funds Are Right For You Fidelity Vs Vanguard Investment Guide

How To Invest In Bonds White Coat Investor

Fidelity Index Funds For Beginners District Capital Management

Tis The Capital Gains Distribution Season

Fidelity Money Market Funds How To Choose The Best One

New Portfolio Manager Appointments